What is risk management framework: a UK guide to resilience

Think of a risk management framework as a company’s game plan for dealing with uncertainty. It's a structured approach—a set of guidelines, processes, and practical wisdom—that a business uses to spot, analyse, and handle potential risks. More than just a document, it’s a strategic blueprint that helps a company move from simply reacting to problems as they arise to proactively shaping its own future.

Defining Your Strategic Blueprint For Resilience

When many business owners hear "risk management framework," they imagine a bulky, restrictive manual collecting dust on a shelf. The reality is the complete opposite. It’s better to see it as the architectural plans for your business’s stability. Just as a building’s design ensures it can weather a storm, a solid framework helps your organisation navigate everything from economic slumps to cyber threats and supply chain hiccups.

A good framework provides the structure you need to make smart, informed decisions. It shifts your operations from a constant state of 'firefighting' into one of proactive control and preparedness. For any UK professional services firm trying to grow in a world of complex regulations and market swings, this strategic mindset is essential. A practical example is an accountancy firm that uses a framework to manage the risk of legislative changes, ensuring they can advise clients accurately and avoid professional negligence claims.

Moving Beyond a Simple Checklist

It's easy to mistake a framework for a simple checklist or a one-time project to be ticked off and forgotten. In truth, it's a living, breathing cycle that should become woven into the fabric of your company culture. It's there to guide everything, from how your team handles daily tasks to the big-picture strategic goals you set for the future.

The real purpose here is to build a repeatable and reliable process for managing uncertainty. By standardising how everyone in your team thinks about and responds to risk, you foster clarity and build confidence. This structured approach makes sure every person understands their part in protecting the business and, just as importantly, in spotting and seizing new opportunities. To see what this looks like in practice, this guide to a resilient risk management strategy offers some excellent insights.

The Connection to Regulatory Duties

Here in the UK, a robust framework isn't just a 'nice-to-have'—it's often a core part of meeting your legal duties. It creates a defensible system that demonstrates due diligence to regulators, investors, and customers. This organised approach is fundamental to achieving and maintaining compliance across the board.

A risk management framework bridges the gap between high-level business objectives and the practical steps needed to protect assets and ensure operational continuity. It transforms risk from a vague threat into a manageable business variable.

For instance, a law firm's framework would directly influence its data protection strategies under GDPR. This includes processes for client data handling, secure communication, and breach notification protocols, which are all critical parts of its legal responsibilities. We explain more about how this works in our guide on what is regulatory compliance. By building these legal requirements into your framework from the start, you ensure that risk management and compliance are working together to protect your organisation.

What Are the Core Components of a Risk Management Framework?

To really get what a risk management framework is, we need to lift the bonnet and see how it works. Think of it less like a static checklist and more like a continuous cycle. An effective framework is built on four interconnected stages, each one feeding logically into the next, creating a repeatable process for navigating uncertainty.

This structure gives a business a systematic way to find, understand, and act on the risks and opportunities that inevitably come its way. Let's break down these core components, using a practical example of a UK-based marketing consultancy to bring them to life.

1. Risk Identification

First things first, you have to spot potential risks before they have a chance to cause any trouble. This isn't about gazing into a crystal ball; it's a methodical process of asking "what if?" It means brainstorming with your team, looking back at past incidents, and taking a hard look at your internal processes and what’s happening in the wider market.

For our marketing consultancy, this goes far beyond simply worrying about losing a client. Real risks could be the sudden departure of their lead creative director, a vital software platform becoming obsolete, new data privacy laws messing with campaign strategies, or even the reputational fallout from a campaign that misses the mark. For a professional services firm, this would also include risks like key person dependency or the loss of intellectual property.

2. Risk Assessment and Analysis

Once you’ve got a list of potential risks, it’s time to size them up. This stage is all about figuring out two key things: the likelihood of the risk actually happening, and the potential impact it would have on the business if it did. This analysis is crucial because it helps you prioritise what needs your immediate attention and what can simply be monitored.

Our consultancy would need to analyse each risk on its list. For instance, losing their biggest client—who brings in 40% of revenue—would clearly be rated as having a severe impact. A data breach, while perhaps less likely if good controls are in place, would also carry a high impact due to potential fines and reputational damage. Getting this analysis right is fundamental to implementing effective vulnerability management best practices.

To clarify how these components fit together, here’s a quick summary:

Core Components of a Risk Management Framework

| Component | Purpose | Example Action for a UK Consultancy |

|---|---|---|

| Risk Identification | To proactively find and document potential threats and opportunities before they materialise. | Running a workshop to brainstorm risks like key staff leaving or a major social media platform changing its algorithm. |

| Risk Assessment & Analysis | To evaluate the likelihood and potential impact of each identified risk to prioritise focus and resources. | Scoring the risk of losing a top client as "High Impact, Medium Likelihood" due to a competitor's aggressive pricing. |

| Risk Response | To select and implement a strategy for addressing each significant risk (e.g., accept, avoid, transfer, or mitigate). | Taking out professional indemnity insurance to transfer the financial risk of a client claiming negligence. |

| Risk Monitoring & Review | To continuously track risks and review the framework's effectiveness, making adjustments as the business environment changes. | Setting a quarterly diary reminder to review the risk register and update it based on new client projects or market shifts. |

This table shows the clear, cyclical nature of the framework, turning abstract concepts into concrete, manageable actions.

3. Risk Response

After assessing your risks, you have to decide what to do about them. The response isn't always about eliminating the risk entirely; it’s about choosing the smartest strategy for your business. Generally, you have four main options:

- Accept: For minor risks with a low impact and low likelihood, you might just decide to accept them. For example, a small design agency might accept the minor financial risk of a printer malfunctioning before a non-critical internal meeting.

- Avoid: If a risk is just too big to stomach, you can choose to avoid it altogether. This could mean turning down a project that’s well outside your team’s expertise. A financial advisory firm might avoid offering advice on unregulated cryptocurrency investments to prevent legal and reputational damage.

- Transfer: This involves shifting the financial impact of a risk onto someone else. The most common way to do this is through insurance, like professional indemnity or cyber liability cover.

- Mitigate: This is about taking proactive steps to reduce either the likelihood or the impact of a risk. For our consultancy, mitigating the risk of losing that major client could mean working to diversify its client base or strengthening the relationship with new service offerings.

4. Risk Monitoring and Review

Finally, and this is the part people often forget, a risk management framework isn't a 'set it and forget it' document. It needs to be a living part of your business, which means continuous monitoring and regular reviews. This creates a vital feedback loop, ensuring your framework stays relevant as your business and the world around it changes.

A framework's true strength lies in its dynamism. Consistent monitoring ensures your organisation adapts to new threats and doesn't rely on outdated assumptions, keeping your responses sharp and relevant.

Our marketing consultancy should probably review its risk register every quarter and do a full framework review once a year. But if something major happens—like they decide to expand into a new market, or a disruptive new competitor appears—that should trigger an immediate review. This ensures their blueprint for resilience is always up to date.

Why Your UK Business Needs This Framework

Knowing the components of a risk management framework is one thing, but seeing how they drive real-world business success is another entirely. For any UK professional services business, a formal framework isn't just about playing defence; it's a powerful tool for unlocking growth and stability. It shifts risk management from a box-ticking exercise into a core driver of value that genuinely strengthens your entire operation.

This structured approach forces you to consider potential bumps in the road before you commit resources, sharpening your strategic decision-making. When your plans are built on a clear-eyed awareness of risk, you're in a much better position to invest confidently, pivot when needed, and sidestep those costly surprises that can completely derail progress. It ensures your business strategy is both ambitious and firmly grounded in reality.

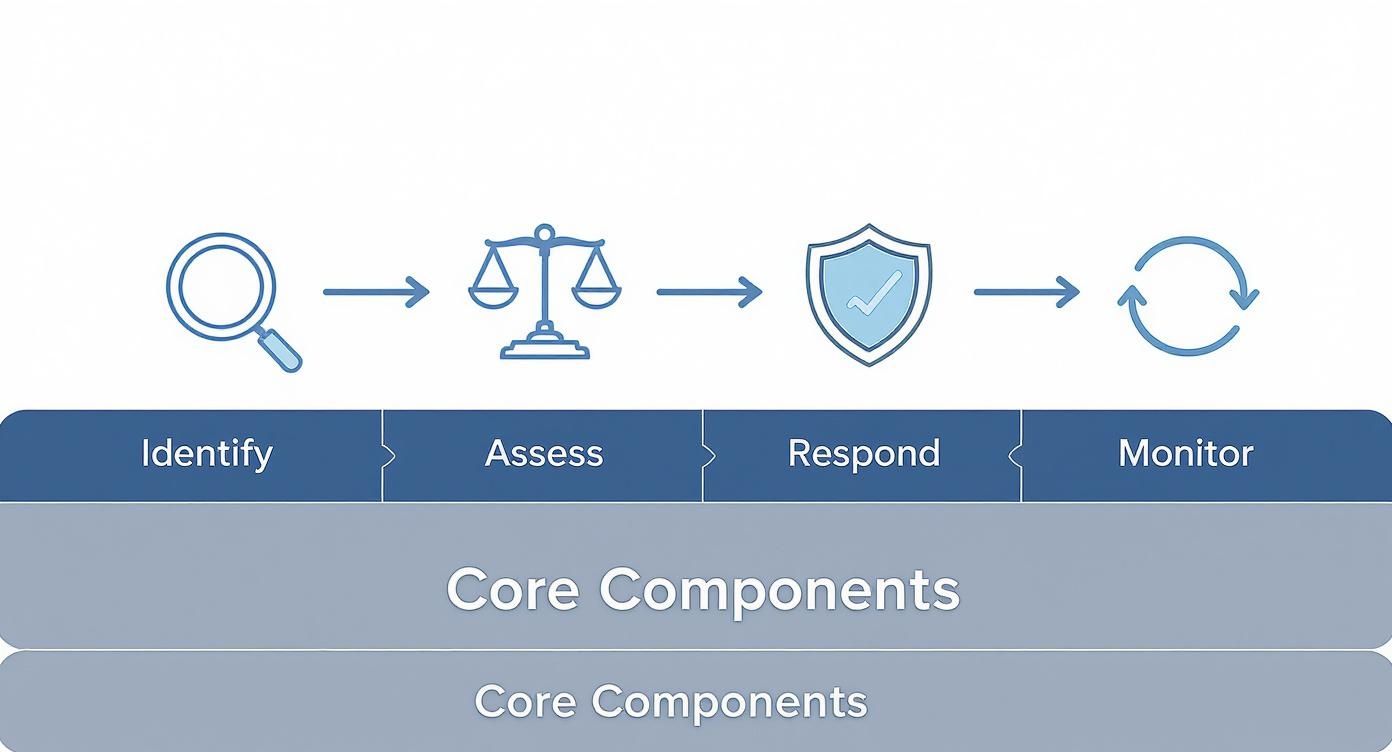

The infographic below shows how this process works in a continuous loop, from spotting risks to keeping a close watch on them.

This simple cycle highlights how each stage logically follows the last, creating a dynamic and repeatable system for handling uncertainty.

Building Resilience and Stakeholder Confidence

Beyond shaping your internal strategy, a framework makes regulatory compliance far less of a headache. In the UK, navigating complex rules like GDPR and various industry-specific regulations is simply not optional. A framework gives you a structured, auditable trail proving you've done your due diligence, making it much easier to meet your legal obligations and avoid hefty penalties. In fact, it's a critical part of any effective business continuity strategies designed to keep your doors open no matter what.

This proactive approach also builds immense trust with everyone who has a stake in your business. Investors are far more likely to back a company that can show it has a firm grip on its risks. At the same time, clients feel more secure partnering with a business that's prepared for the unexpected, and your employees gain confidence from knowing their workplace is stable and secure.

A well-implemented risk management framework transforms uncertainty into a competitive advantage. It builds a resilient organisation that can not only survive unexpected challenges but also thrive by seizing opportunities that others might miss.

A Practical Example in the UK Fintech Sector

Let’s imagine a UK fintech start-up trying to make its mark in a volatile market. Through its risk management framework, the leadership team identified a "funding winter"—a period where venture capital becomes incredibly scarce—as a high-impact, medium-likelihood risk.

Their response plan included several smart mitigation strategies:

- Cost Optimisation: They pre-emptively trimmed non-essential operational costs to become leaner.

- Revenue Diversification: The team pushed forward the launch of a secondary, more stable revenue stream.

- Extended Runway: During a good market spell, they secured a modest line of credit to act as a financial buffer.

Sure enough, the market tightened and funding all but dried up. Many competitors were caught completely off-guard, forced into drastic cuts or even shutting down. But because our hypothetical start-up had anticipated and prepared for this exact scenario, it successfully navigated the downturn. The framework didn't just prevent a crisis; it gave the business the resilience to keep going and emerge even stronger when the market recovered.

How to Implement Your Risk Management Framework

Understanding the theory behind a risk management framework is one thing; actually building one that works for your business is another entirely. It can feel like a mammoth task, but the trick is to break it down into a series of clear, manageable steps.

This isn't about creating a dusty document that sits on a shelf. It's about building a practical tool. Let’s walk through how to put a framework in place, piece by piece, so it becomes a genuine asset for your business.

Secure Leadership Buy-In

Before you write a single word, you need the full-throated support of your company's leadership. This is non-negotiable. When the people at the top champion risk management, it signals to everyone that this is a core business priority, not just another box-ticking exercise.

This high-level backing is what unlocks the resources you'll need—people's time, a budget, and the authority to get things done. It gives the entire project the weight it needs to succeed. For example, if the managing partner of a law firm champions the new risk framework, junior lawyers are far more likely to adopt new client intake procedures designed to mitigate risk.

A risk management framework without leadership support is like a ship without a captain. It might look impressive, but it won’t go anywhere meaningful and will be quickly knocked off course by the first sign of a storm.

Establish Clear Ownership

With leadership on board, the next question is: who owns this? You need to assign clear responsibility. In some companies, this might be a small risk committee with people from different teams. For a smaller SME, it could be a single, dedicated person, such as the practice manager in a small architectural firm.

The important thing is to have a defined point of contact. This individual or group will steer the ship—overseeing the framework's development, rollout, and ongoing maintenance to ensure it stays relevant.

Define Your Risk Appetite

Now for a crucial step: deciding how much risk your business is actually willing to take to meet its objectives. Your risk appetite acts as a guide rail for decision-making across the company. It helps everyone understand when to push forward and when to pull back.

Think of it this way: a tech start-up might have a huge appetite for risks related to product innovation but almost zero appetite for anything that compromises customer data. For a management consultancy, the appetite for financial risk in taking on a new, unproven client might be low, while the appetite for strategic risk in exploring a new service line could be high. Defining these boundaries gives your team a clear and consistent benchmark for every decision they make.

Select a Practical Model

There's no need to start from a blank page. Established models can give you a fantastic starting point. One of the most respected is ISO 31000, which provides a set of principles and general guidelines rather than a strict, one-size-fits-all rulebook.

For an SME, the smart move is to borrow the principles that make sense for you, not get lost in jargon. Use a model as a blueprint to structure your thinking on how to spot, analyse, and respond to risks in a logical, repeatable way.

Develop a Central Risk Register

The risk register is where theory meets practice; it's the operational heart of your framework. At its core, this can be as simple as a well-structured spreadsheet that lists every risk you've identified.

For each risk, your register should log the essentials:

- A plain-English description of the risk.

- An assessment of its likelihood and potential impact.

- The designated owner responsible for keeping an eye on it.

- The chosen response strategy (e.g., mitigate, accept, transfer, or avoid).

- The current status of any actions being taken.

This central log becomes your single source of truth, making it simple to see your company's entire risk profile at a glance.

Foster a Risk-Aware Culture

Ultimately, a framework is only as good as the people using it. To make it stick, you need to build a risk-aware culture where every single person feels comfortable and empowered to flag potential issues. This can't be a top-down mandate; it has to be a shared responsibility.

Run workshops to get teams involved in identifying risks. Provide simple training on how to use the risk register. For specific, high-stakes processes, detailed guides like a Bank Onboarding Risk Playbook can be incredibly valuable. When everyone sees risk management as part of their job, you build true resilience right into the DNA of your business.

Seeing the Framework in Action at a National Level

To really grasp what a risk management framework does, it helps to zoom out and look at one working on a massive scale. While a business manages risk to protect its bottom line, a government uses a framework to protect an entire country. It’s the ultimate high-stakes example, and it shows just how powerful a structured approach to risk can be.

The UK Government's national strategy is a perfect real-world case study. It takes all the core principles we’ve discussed—identifying, assessing, responding, and monitoring—and applies them to safeguard everything from national infrastructure to public safety and the economy. This isn't just theory; it’s a living, breathing system built to handle immense complexity.

The National Risk Register Explained

The cornerstone of the UK's strategy is the National Risk Register (NRR). It’s a public document that lays out the most serious risks the country faces, from terrorism to pandemics. You can think of it as the nation's own risk register, shared openly so that everyone, from local councils to private companies, can get on the same page.

The 2025 version of the register details 89 different risks across nine broad themes. We’re talking about everything from cyber-attacks and supply chain failures to extreme weather events. What’s really interesting about the 2025 update is its shift to a more dynamic model. Instead of a static list that gets updated every few years, risks are now continuously reassessed based on the latest intelligence. To understand this shift better, you can explore more about the 2025 NRR updates.

Lessons for Your Business

So, what can a small or medium-sized business learn from all this? The biggest takeaway is that risk management isn't a "set it and forget it" task. It’s a constant cycle of review and adaptation. A static plan is a plan that’s already out of date. A dynamic one, however, gives you the agility to handle new challenges as they pop up.

The National Risk Register illustrates a critical principle: a successful risk management framework must be a living system. It should inform strategic decisions, guide preparedness activities, and evolve in response to a changing environment.

By adopting this mindset, even the smallest professional services firm can build a far more resilient operation. The goal is the same, whether you're protecting a nation or a company: to turn uncertainty from a vague threat into a manageable part of your strategic planning.

Common Questions About Risk Management Frameworks

Even with the best guidance, it's natural for questions to pop up when you start putting a risk management framework into practice. Getting your head around the concept often means clearing up a few common points of confusion. Let’s tackle some of the most frequent questions we hear from UK business owners.

Framework vs. Plan: What’s the Difference?

It’s easy to use these terms interchangeably, but they operate on two completely different levels. Think of it like the difference between an entire cookbook and a single recipe.

The framework is your cookbook. It’s your business’s whole philosophy and system for handling risk—the principles, the structure, and the processes. It sets the rules for your kitchen and defines what good cooking looks like.

A risk management plan, on the other hand, is the recipe. It’s a specific, detailed document you create to tackle a particular risk identified by your framework. So, your framework might flag cybersecurity as a major risk area, which then leads you to create a specific incident response plan. For a professional services firm, the framework identifies a risk of data loss, while the plan details the specific backup procedures, responsible staff, and recovery timescales.

How Often Should We Review Our Framework?

Your risk management framework should be a living document, not something you create once and file away. Plan for a full, formal review at least annually. This ensures it still makes sense for your business goals and reflects the world you're operating in.

That said, some events should trigger an immediate review, no matter when your annual one is scheduled. These include:

- Big internal changes: Launching a new service, expanding into a new market, or a major shake-up of your team or operations.

- Major external events: New UK regulations coming into force, a big shift in the economy, or a disruptive technology emerging in your industry.

- After a risk event: If a major incident occurs, a post-mortem is crucial. You need to learn from what happened and use those lessons to strengthen your defences.

Can We Do This Without Expensive Software?

Yes, absolutely. For most small and medium-sized professional services firms, the process is far more important than the platform. The quality of your thinking and analysis matters much more than the fancy tool you use to record it.

A well-organised spreadsheet often makes a perfect risk register to get you started. It’s a tool everyone understands, it’s accessible, and it costs nothing. As your business grows and your risks become more complicated, you might want to look at specialised software. But starting simple is nearly always the right move.

At SES Computers, we help businesses across Dorset and Hampshire build resilience from the ground up, starting with solid IT infrastructure and proactive security. If you need a partner to help manage your technology risks, get in touch with our local team. Find out more about our managed IT support.