IT Support for Accountants: A UK Firm’s Guide

For any UK accountancy firm, having the right IT support for accountants isn't just a good idea—it's an absolute necessity for staying secure, efficient, and compliant. General IT services simply don't have the deep-seated understanding of financial regulations or the specialised software that accountants rely on every single day. This is crucial for protecting sensitive client data and keeping operations running smoothly, especially during crunch times like the Self Assessment deadline.

Why Generic IT Just Doesn't Work for Modern Accountancy Firms

Think about it this way: would you ask your local GP to perform intricate brain surgery? Of course not. While both are qualified doctors, the GP lacks the specialised tools, niche knowledge, and hands-on experience needed for such a high-stakes operation. Trusting your accountancy firm's IT to a general provider is much the same gamble, and the stakes are far too high for a one-size-fits-all solution.

Modern accountancy practices face a unique set of pressures. You're constantly up against tight deadlines, handling incredibly sensitive information, and navigating a minefield of complex regulations. A standard IT company can probably fix a printer or reset a password, but do they truly grasp the devastating impact of a server failure in the final week of January? For example, if your practice management software goes down on the 30th of January, a generic provider might log a ticket with a standard four-hour response. A specialist understands this is a crisis requiring an immediate, all-hands-on-deck resolution. It’s this fundamental disconnect that makes generic IT a poor fit.

The Unique IT Demands of an Accounting Practice

The technology an accountancy firm needs is fundamentally different from that of a typical business. Your entire operation is built on a foundation of precision, confidentiality, and absolute reliability.

A specialised IT partner gets it. They understand that:

- Compliance is king: Your systems have to comply with strict UK regulations like GDPR and meet the exacting standards of professional bodies like the ICAEW.

- Your software is specific: Your team lives in applications like Sage, Xero, or Iris. These aren't just everyday programmes; they need expert management and someone who can speak the language of the software vendors.

- Uptime is non-negotiable: System downtime isn't a mere inconvenience. During peak season, it can cause missed deadlines, hefty financial penalties, and a catastrophic loss of client trust.

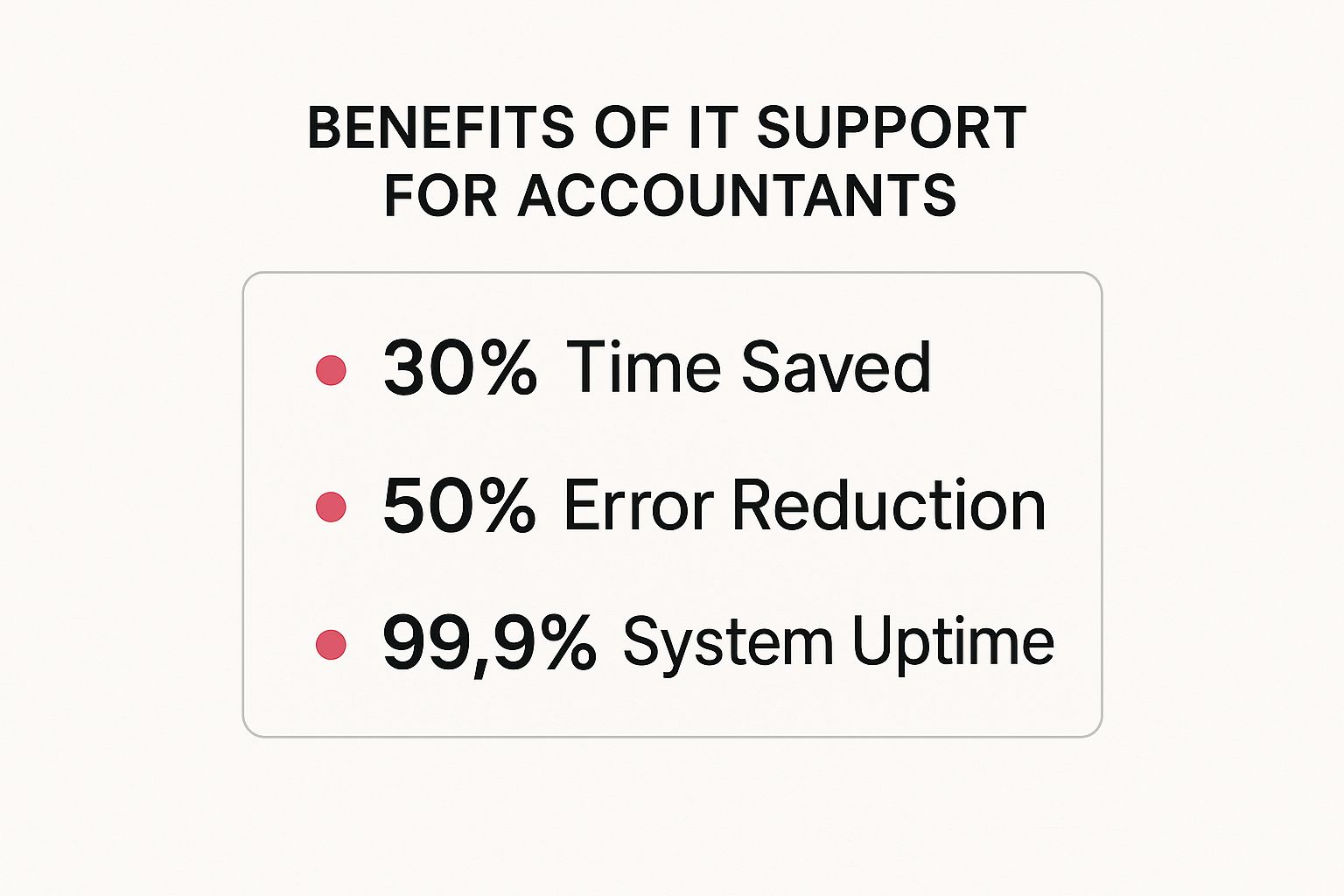

A targeted IT strategy delivers real, measurable improvements to your firm's efficiency and resilience.

The figures above—30% time saved, 50% error reduction, and 99.9% system uptime—show just how much of a difference the right IT approach can make.

Moving Beyond Break-Fix Support

Perhaps the biggest pitfall of generic IT support is that it’s almost always reactive. An accountant's IT strategy can't just be about fixing things when they go wrong. It has to be proactive, anticipating problems before they happen and building a robust infrastructure that supports your firm's growth while defending against constant threats.

Moving your firm to a secure, managed environment, for instance, can unlock huge gains in productivity. To see how, learn more about how hosted desktops will make your accountancy firm more efficient in our detailed guide.

A proactive IT partner doesn't just solve today's problems; they build a technological foundation that prevents tomorrow's crises, ensuring your firm remains secure, compliant, and consistently productive.

Ultimately, choosing specialised IT support for accountants is a direct investment in your firm's reputation and its future. It’s about finding a partner who speaks your language and understands that in the world of accounting, there is simply no room for error.

Key Services In Specialised IT Support

When an IT team works closely with accountants, it’s not just about putting out fires. It’s about building a smooth-running engine where technology empowers every task—from client consultations to finalising year-end accounts.

A specialised IT support for accountants partner flips the script from reactive to proactive. Instead of waiting for systems to crash, they keep tabs on your infrastructure 24/7, so your firm isn’t caught off-guard during critical deadlines.

Proactive Network Monitoring And Maintenance

Picture your IT network as the nervous system of your practice. Any glitch here can ripple out and slow everything down. By using advanced monitoring tools, your IT partner keeps a vigilant eye on servers, workstations and network devices 24/7.

For example, a monitoring tool might flag that a server's storage is 95% full. A proactive IT partner will address this by archiving old data or expanding storage capacity over the weekend, preventing a crash that could have paralysed the firm on a busy Monday morning. Small alerts—like a hard drive nearing capacity or overdue security patches—get addressed long before they spark downtime. The payoff? Fewer emergency IT tickets and more hours spent on client work.

Strategic Technology Guidance And Vendor Management

Think of your specialist IT partner as a virtual Chief Technology Officer. They’ll craft a roadmap for your technology—whether that means plotting a cloud migration or automating routine reconciliations.

Juggling software vendors can be a productivity drain. When issues emerge with platforms like Sage, Xero or Iris, your dedicated team will:

- Act as your champion, liaising directly with vendors on technical snags

- Manage licence renewals, so you only pay for what you actually need

- Escalate urgent problems, cutting through red tape and freeing your accountants for billable work

An IT partner who speaks the language of accountancy software turns vendor headaches into swift solutions, keeping your systems and your people perfectly aligned.

Robust Business Continuity And Disaster Recovery

In accountancy, data is everything. A ransomware strike or hardware failure on payday can grind your operations to a halt. A comprehensive business continuity plan does more than back up files—it lays out a clear path to recovery.

Imagine the worst: a cyberattack locks down all your client records just as payroll is due. With a specialist disaster recovery service, your partner can:

- Quarantine the threat to stop it spreading across your network

- Wipe and rebuild affected systems securely and efficiently

- Restore your environment from a clean backup in hours, not days

What could be a full-scale crisis becomes a well-managed interruption with minimal impact on client deadlines.

Comparing General IT Support vs Specialist Accountant IT Support

Below is a quick comparison of what you might expect from a typical IT firm versus a provider dedicated to the accountancy sector.

| Service Area | General IT Provider | Specialist Accountant IT Provider |

|---|---|---|

| Industry Knowledge | Works across multiple sectors | Deep familiarity with accountancy regulations and workflows |

| Compliance Expertise | Basic advice on standards | In-depth support for GDPR, SOX and other financial regulations |

| Software Support | Handles common business applications | Expert in Sage, Xero, Iris and other accountancy platforms |

| Monitoring | Standard network alerts | 24/7 oversight tailored to financial operations |

| Disaster Recovery | Generic backup and restore | Rapid failover strategies designed for critical financial data |

| Vendor Liaison | Advises you on vendor contacts | Acts as your representative, managing licence renewals and escalating technical issues |

This comparison makes one thing clear: when your IT provider truly understands the accountancy world, you move from firefighting to confident, uninterrupted service.

Strengthening Security and Ensuring Compliance

For any accountant, data isn't just data; it's the financial lifeblood of your clients. Protecting it isn't just an IT job—it’s a fundamental business duty. With cyber threats becoming more targeted and sophisticated by the day, a solid security strategy isn't a luxury; it's essential for survival.

The risks are far more specific than a generic computer virus. Think about a cunning phishing email, perfectly disguised as a legitimate client request, tricking a junior accountant into sending sensitive payroll files to a fraudster. Or imagine ransomware locking up every single client file just days before a tax deadline, grinding your entire practice to a halt. These aren't far-fetched scenarios; they're happening to UK firms right now.

This is where specialised IT support for accountants comes in. It goes far beyond simply installing antivirus software. It’s about building a multi-layered defence system, one that's designed to counter the specific threats your industry faces and secure every digital touchpoint.

Navigating the Maze of GDPR and Data Protection

In modern accountancy, you can't afford to ignore regulatory compliance. The General Data Protection Regulation (GDPR) isn’t just a list of suggestions; it has real legal and financial teeth. A single breach can trigger consequences that go well beyond a quick system reboot.

Let’s say a small firm suffers a data breach, and client National Insurance numbers and tax records are exposed. The Information Commissioner’s Office (ICO) could step in and issue a fine of up to 4% of the firm's annual turnover. That financial hit is painful, but the damage to your reputation is often far worse.

The real cost of a compliance failure isn't the ICO fine. It's the permanent erosion of client trust. Once that’s gone, earning it back is a monumental, if not impossible, task.

A seasoned IT partner gets this. They don't just fix problems after they happen; they put proactive measures in place to stop them from occurring in the first place, all while meticulously documenting every security protocol. This paper trail is crucial for proving due diligence to regulators and giving clients peace of mind. Keeping on top of these rules is vital, which is why a comprehensive GDPR compliance checklist for UK businesses can be such a valuable tool for any practice.

Building a Defence in Depth

A single firewall just doesn't cut it anymore. Proper cybersecurity for an accountancy practice demands a deep, layered approach that defends your systems from every possible angle. This strategy, often called 'defence in depth', works on a simple principle: if one security layer fails, there are several more behind it ready to stop an attack in its tracks.

A specialist IT provider will build a security framework with several core components:

- Advanced Threat Detection: This isn't just antivirus. It's about using smart tools that constantly watch your network for strange behaviour, spotting potential threats like ransomware before they can do any damage.

- Email Security and Filtering: With 91% of cyberattacks starting as a phishing email, you need an advanced filter. For example, a system could automatically quarantine an email pretending to be from HMRC that asks for login credentials. These systems block malicious emails, dodgy attachments, and dangerous links long before they land in your team's inboxes.

- Regular Security Audits: We’re talking about proactive vulnerability scans and penetration tests. The goal is to find and patch weaknesses in your systems before criminals have a chance to discover them.

- Access Control Management: Strict rules are put in place to ensure people only have access to the data they absolutely need for their job. This minimises the potential fallout if an account is ever compromised.

This layered strategy transforms your firm's security from a simple gate into a well-defended fortress.

The Human Element: Staff Security Training

At the end of the day, your team is a critical line of defence. The most expensive technology in the world can be undone by one simple human error. Recognising this, a key service from any specialised IT provider is ongoing staff training.

This isn't about a boring, one-off seminar. It's a continuous programme that aims to build a security-first culture within your firm. These training sessions often cover:

- Phishing Simulations: Controlled, fake phishing emails are sent to staff to see how they react. It’s a safe way to test awareness and provide instant coaching if someone clicks a suspicious link.

- Best Practice Workshops: Practical training on creating strong passwords, spotting social engineering tricks, and handling sensitive client data securely.

- Data Handling Protocols: Clear, simple procedures for sharing and storing confidential files, whether your team is in the office or working from home.

By arming your employees with knowledge, you turn your biggest potential weakness into your strongest defensive asset. It’s this blend of advanced technology, regulatory know-how, and human training that ensures your firm is not just protected but fully compliant, safeguarding both your data and your hard-earned reputation.

Using Cloud Technology for a More Agile Practice

The days of an accountancy firm being tied to a single, physical office are well and truly over. To stay competitive, you need the ability to work securely and efficiently from anywhere, and it’s cloud technology that makes this agility possible. A specialist in IT support for accountants can cut through the jargon, turning the cloud from an abstract concept into a powerful, practical asset for your firm.

This isn't just about storing files online. It's a fundamental shift in how you operate, creating a more flexible and responsive business model. Think about it: a senior partner is at a conference and needs to review an urgent client file. With a properly managed cloud setup, they can securely access everything they need from a laptop or tablet, meaning critical work doesn't grind to a halt just because they're out of the office.

This kind of operational freedom is fast becoming the industry standard. A recent Wolters Kluwer report on cloud accounting trends found that 47% of UK accountants now use purely cloud-based software, with another 34% using a hybrid model. The impact is clear: 74% of firms that have moved to the cloud report profit growth, all thanks to better accessibility and huge time savings.

Better Collaboration and a Sharper Client Service

Cloud technology dissolves the old barriers between your team and your clients. Forget insecure email attachments or clunky file transfer sites; a managed cloud environment acts as a central, secure hub where everyone can work together seamlessly.

Client portals are a perfect example of this in action. Your IT partner can set up a secure, branded portal that allows your firm to:

- Share large files instantly: No more wrestling with email size limits when sending year-end accounts or audit files.

- Request and receive documents with ease: Clients can upload bank statements, receipts, and payroll data directly into a secure, dedicated folder.

- Get approvals in minutes, not days: Send documents for digital signature and get them back almost immediately.

This doesn’t just accelerate your internal workflows. It also delivers a far more professional and organised experience for your clients, building confidence and trust in your practice.

Swapping On-Premise Risks for Cloud Resilience

Many firms are still hesitant to ditch their on-premise servers, usually because of security worries. The irony is that a well-managed cloud environment, supported by a specialist IT provider, is almost always far more secure and resilient than a server humming away in an office cupboard.

Just think of the physical risks to that server: a fire, flood, theft, or even a simple hardware failure could wipe out your firm’s entire data history in an instant. By contrast, cloud infrastructure is housed in purpose-built data centres with backup power, redundant cooling, and layers of physical and digital security that no small business could ever hope to match on its own.

With a managed cloud solution, you're essentially outsourcing your security and resilience to dedicated experts. The burden of server maintenance, security patches, and backups shifts to your IT partner, freeing you up to focus on what you do best: serving your clients.

Backups are the perfect illustration. Instead of relying on a staff member to remember to swap tapes, a managed cloud solution automates the whole thing. Your data is copied multiple times a day to geographically separate locations, ensuring that even if the worst happens, a full recovery is just a few clicks away. For any firm considering the move, it’s worth taking the time to learn more about professional cloud migration services to see how a seamless transition is properly planned and carried out.

At the end of the day, moving to the cloud is about future-proofing your practice. It gives your team the freedom to work from anywhere, improves how you interact with clients, and offers a level of security and business continuity that on-premise systems simply can't compete with. It’s the foundation for building a truly agile, efficient, and resilient accountancy firm.

Future-Proofing Your Firm with AI and Automation

Staying ahead in the accounting world isn't just about keeping up with regulations; it's about embracing technology that helps you work smarter. Modern IT support for accountants has moved far beyond simply fixing printer problems. It’s now about proactively finding and integrating tools like artificial intelligence (AI) and automation to give your firm a real competitive advantage.

This isn't about replacing your talented accountants with robots. Think of these technologies as powerful assistants that handle the monotonous, time-consuming tasks that drain your team's energy. This frees up your people to focus on strategic, high-value advisory work where their expertise truly makes a difference for your clients.

Putting AI and Automation to Work in Your Practice

So, what does this look like in the real world? Imagine an AI system that can scan thousands of supplier invoices, instantly pulling out key data, flagging anything that looks off, and plugging it straight into your accounting software. That one change could save your team hundreds of billable hours every single year.

Here are a few more practical examples:

- Anomaly Detection: During an audit, an AI can sift through massive datasets in minutes, pinpointing unusual transactions or patterns that might suggest fraud. This is something that could take a human auditor days of painstaking work to uncover.

- Automated Reconciliations: Automation tools can handle bank reconciliations on their own, matching thousands of entries against bank statements with incredible accuracy. They only flag the few exceptions that actually need a human eye.

- Predictive Analytics: AI can analyse years of financial data to forecast cash flow, model different business scenarios, and help you offer clients genuinely insightful, forward-looking advice.

This isn't some distant future concept; it's happening right now in the UK. Recent figures show that over 30% of UK accountancy firms have already brought AI into their operations, and another 23% are planning to do so in the next year. You can explore more about these UK accounting trends for 2025 on hartleyfowler.com.

Your IT Partner as a Strategic Enabler

A forward-thinking IT partner is absolutely vital in making this shift. They won’t just throw new software at you; they’ll help you build a proper strategy for adopting it. That means taking the time to understand your firm’s unique workflows, pinpointing the biggest bottlenecks, and then choosing the right tools to solve those specific problems.

To truly secure your firm's future, it's essential to learn how to automate business processes for better efficiency by finding those repetitive tasks and using technology to streamline them. Your IT provider should be your guide through this entire journey, from the initial chat to full implementation and getting your staff comfortable with the new systems.

The goal is to move beyond simply keeping the lights on. A strategic IT partnership is about empowering your firm with technology that directly boosts efficiency, minimises human error, and unlocks new avenues for profitability.

By taking on the heavy lifting of research, testing, and integration, your IT partner ensures your firm can adopt new tools without a hitch. They manage the technical side of things, so your accountants can enjoy the benefits without needing to become IT experts themselves. This kind of collaboration ensures your firm doesn’t just keep up with change, but actually leads the way.

How to Choose the Right IT Partner

Choosing a provider for your firm's IT support for accountants isn't just a technical decision; it's a critical business move. This partner will hold the keys to your most sensitive client data and become the backbone of your daily operations. You need a structured approach to find a provider who truly gets the unique pressures of the accountancy profession.

First things first, look past the generic promises of "fast service" and start digging into the details that matter to your practice. A potential partner’s deep understanding of the accountancy sector is non-negotiable. They shouldn't just recognise the names of your software; they need to understand its quirks, its integration challenges, and how it fits into your workflow. Once you're ready to make a change, knowing how to outsource IT services effectively will set you up for a successful transition.

Key Evaluation Criteria

When you start comparing providers, cut through the sales pitch and focus on tangible proof of their skills. A solid Service Level Agreement (SLA) is a good start, as it puts their promises about response times down on paper.

But an SLA is only half the story. You need to get a feel for their real-world performance.

- Industry Experience: Do they already work with other accountancy firms? Ask them for specific case studies or, even better, references from firms similar in size and scope to your own.

- Software Proficiency: Test their knowledge. Get them talking about the practice management software you rely on, whether it's Sage, Iris, or Xero. Have they solved tricky issues with these platforms before? For example, ask them how they would troubleshoot a common Sage 50 data corruption issue or an Iris update that fails to apply correctly across a network.

- Compliance Acumen: How will they keep your data handling compliant with regulations like GDPR? You’re looking for a confident, detailed answer here. Any hesitation should be a massive red flag.

Questions to Ask a Potential IT Provider

Go into your meetings prepared with a list of direct questions. This helps you get straight to the point and see if they really know their stuff. A good provider won't be fazed by this; they'll see it as a chance to prove their expertise.

- Can you share some anonymised examples or case studies from other accountancy firms you support?

- What are your guaranteed response and resolution times if our main system goes down during tax season?

- How do you proactively watch our systems for security threats before they become a problem?

- Walk me through your data backup and disaster recovery process. Realistically, how quickly could you get us back up and running after something like a ransomware attack?

A true technology partner does more than just fix what's broken. They act as a strategic advisor, helping you align your technology with your business goals to enhance security, improve efficiency, and support long-term growth.

Ultimately, the aim is to find a provider that feels like an extension of your own team. Their technical ability has to be matched by a genuine understanding of your firm’s pressures and a clear commitment to your success. Taking the time to do this careful evaluation ensures you find a partner who will protect your reputation and empower your practice for years to come.

Your Questions, Answered

Deciding to bring in a specialist IT partner is a big step, and it’s natural to have questions. We’ve been helping accountancy firms across the UK with their technology for years, so here are some straightforward answers to the questions we hear most often.

What’s the Real Cost of Specialised IT Support for Accountants?

It really depends on the size of your firm and exactly what you need. Most IT partners work on a per-user, per-month basis, which typically lands somewhere between £30 and £100+ per user.

This usually covers everything from day-to-day helpdesk support to proactive security monitoring and managing your other software vendors. But it’s best not to think of it as just another overhead. Consider it an investment. A single IT hiccup during tax season could easily cost you more in lost billable hours than a whole month of professional support. For example, if three accountants lose half a day's work due to a system outage in January, the lost billable revenue could easily exceed £1,000, making the monthly support fee look very reasonable.

Will Switching IT Providers Cause Chaos?

It’s a common worry, but it shouldn't. Any reputable IT partner worth their salt will have a well-oiled process designed to make the switch feel almost invisible to your team. The transition is meticulously planned, with the heavy lifting like data migration happening out of hours.

The gold standard for a handover is simple: your team leaves on a Friday evening and comes back on Monday morning to a faster, more secure system, with a new, friendly support team ready to help.

Your new provider should take the lead completely, coordinating with your old one to ensure a smooth transfer of every password, system detail, and piece of documentation.

What Are the Must-Have Security Measures for an Accountancy Firm?

Standard firewalls and antivirus are just the starting point. Given the sensitive data you handle, you need layers of security working together. Here’s what’s non-negotiable:

- Advanced Email Filtering: Crucial for catching sophisticated phishing emails trying to trick your staff into giving away client data or login details.

- Data Encryption: This ensures that all client files are unreadable to unauthorised eyes, whether they’re sitting on a server or being sent in an email.

- Multi-Factor Authentication (MFA): Adding this simple second step for logging in is one of the single most effective ways to block hackers from accessing accounts.

- Regular Security Audits: A proactive check-up to find and fix weak spots in your network before they become a problem.

Getting these fundamentals right is absolutely vital for protecting your firm’s reputation and staying on the right side of GDPR.

At SES Computers, we provide expert IT support designed specifically for the unique demands of UK accountancy firms. Contact us today for a free consultation to see how we can help secure your practice.